Solution

Hanvon OCR Financial bill/ form/ documents recognition program

AddTime:2020-01-13 14:52:17 Hits:0

bill/form/documents recognition-----banking system application

System outline

Application background

Accounting treatment provided scientific and effective management for the use of bank funds,and the rigor and security of accounting procedures have been reflected in the transfer of certificate.

Original vouchers are made into packet by counter and relevant departments and sent to post-supervision department.The post-supervision department will audit the validity of the certificate.If there are errors in the registration certificate that do not meet the requirements,the certificate entry will be individually checked through the post-supervision system which works as temporary cabinet water.And then the afterwards ledger records,subject amount,general ledger,accounts will be individually checked with the accounts of the counter.The records discrepancies will register on error table.After supervision,the certificate will be packaged in classification and delivered to archives management center.

For a long time,because of the backward management,bank records management work has been plagued by all kinds of files,collating,stapling and archiving which take a lot of manpower and material resources.While post-supervision and separation of various types of archived documents also waste a lot of manpower and material resources.With the advent of centralized bank account processing mode,how to achieve efficient voucher entry,query and reliable storage has become a major issue that the banking sector faced.The mature of domestic Chinese OCR technology has provided technical guarantee for this issue.

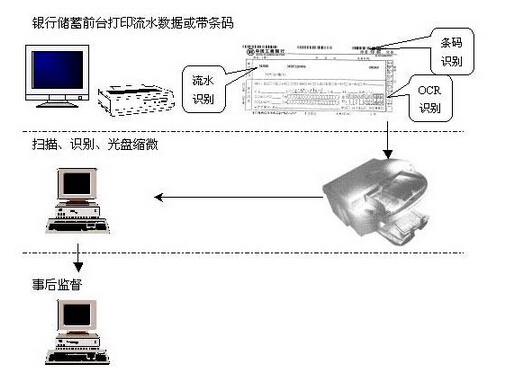

Microfilm archives CD-cum-post-supervision system is one of the computer-aided management and accounting supervision system with bank original file input,optical disk storage,automated management,intelligent search and post-supervision.It uses digital image technology equipment(such as video cameras,high-speed scanners)to input summons images into the computer system with the use of manual entry,water recognition and other means to establish identification credentials index.With a variety of ways of phone,fax and computer queries,records can be inquired while after the checking of water results and OCR recognition results,the data generated can work as water of post-supervision and then the flowing and the flowing of current counter will have batch checking,which really realizes the post-supervision and bank credential archive automation,as well as long-term preservation,intelligent query and scientific management to archives.

With comprehensive advantages of Hanvon leading OCR technology,Hanvon provides an advanced and complete solution for the banking system and achieved good results in a large number of practical applications.

Achievement of objectives

Implement automation of business processes

High-speed acquisition to certificate image:All savings certificates have achieved high-speed acquisition to certificate image by scanning.According to the bank's specific needs,banks can choose different grades of the scanner.

To establish automation of credentials index:"Hanvon OCR bill\form\Documents Identification System"adopts OCR technology or flowing recognition to automatically establish accurate index of credentials which can greatly reduce the workload of manual entry.

The use of OCR technology for automatic acquisition to important credential data:For those data(account number,amount,etc.)that need significant oversight,use OCR technology to extract the actual data that users fill in credentials and make the actual data and accounting data obtained by identifying be checked to generate a data file to be supervised.And provide the data file to the savings post-supervision subsystem and then complete further post-supervision.The system uses the leading domestic Hanvon OCR technology which is mature and reliable and it has been applied in many financial institutions.The system has reached the level of practical application.

The whole background automatic process should be quickly and efficiently:background processing of a single credential(including scanning and OCR)will spend two seconds at most.The success rate of automatic recognition to the types of documents is substantially 100%.For a variety of required monitoring data(account number,amount,etc.),the success rate of OCR automatic recognition will reach above 90%.In addition,there are hand-makeup,special treatment,important credentials checking and focus oversight functions etc.

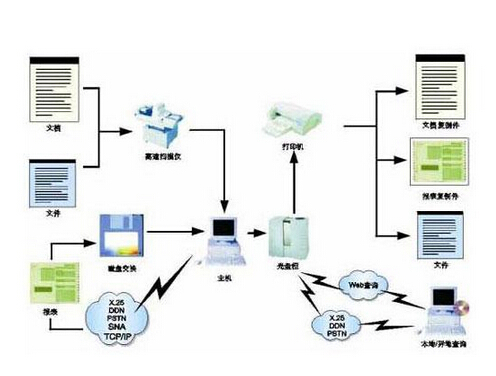

Powerful,convenient and efficient voucher searching function:After OCR automatic recognition,certificate queries can be achieved quickly and easily through LAN or DDN,X,25 lanes on the hard disk or CD-ROM library or MO data on the server.Fuzzy query can be achieved by free combination of a variety of index features;it is safe and reliable to use SOCKET transfer data packets with small network traffic.

Strict post-supervision:According to the data provided by"Hanvon OCR bill\form\document identification system",they works as the afterwards water to record the afterwards subsidiary ledger,accounts amount,general ledger,internal borrowing amount in the account balance,the balance of loan balance,out of balance,and the running account case by case on the hook between afterwards account and current account,transaction-hook between the subsidiary account and general ledger.It can achieve the automation and efficiency of the running-water hook.

Unique error management:The purpose of post-supervision is to find the error of current counter business.Thus,post-supervision fault management is a very important function.Later record all the errors when afterwards counter accounts are inconsistent with the current counter.Error management module will input non-computer error information of the supervision bills,such as incomplete bills,fake bills,illegible bills and the amount altered bills;as well as inconsistent water checking,inconsistent subsidiary ledger,and inconsistent general ledger etc.According to the error information,the generated error report will be presented to higher authorities for analysis,and generate an error notice notification for current counter’s modification.

Featured post-supervision:Mainly adopt water-based batch processing,while supporting single manual entry;the business types support for the public,savings,credit,exchange service and credential management.

Principle of System implementation

System Schematic

bill/form/documents recognition-----banking system application

System outline

Application background

Accounting treatment provided scientific and effective management for the use of bank funds,and the rigor and security of accounting procedures have been reflected in the transfer of certificate.

Original vouchers are made into packet by counter and relevant departments and sent to post-supervision department.The post-supervision department will audit the validity of the certificate.If there are errors in the registration certificate that do not meet the requirements,the certificate entry will be individually checked through the post-supervision system which works as temporary cabinet water.And then the afterwards ledger records,subject amount,general ledger,accounts will be individually checked with the accounts of the counter.The records discrepancies will register on error table.After supervision,the certificate will be packaged in classification and delivered to archives management center.

For a long time,because of the backward management,bank records management work has been plagued by all kinds of files,collating,stapling and archiving which take a lot of manpower and material resources.While post-supervision and separation of various types of archived documents also waste a lot of manpower and material resources.With the advent of centralized bank account processing mode,how to achieve efficient voucher entry,query and reliable storage has become a major issue that the banking sector faced.The mature of domestic Chinese OCR technology has provided technical guarantee for this issue.

Microfilm archives CD-cum-post-supervision system is one of the computer-aided management and accounting supervision system with bank original file input,optical disk storage,automated management,intelligent search and post-supervision.It uses digital image technology equipment(such as video cameras,high-speed scanners)to input summons images into the computer system with the use of manual entry,water recognition and other means to establish identification credentials index.With a variety of ways of phone,fax and computer queries,records can be inquired while after the checking of water results and OCR recognition results,the data generated can work as water of post-supervision and then the flowing and the flowing of current counter will have batch checking,which really realizes the post-supervision and bank credential archive automation,as well as long-term preservation,intelligent query and scientific management to archives.

With comprehensive advantages of Hanvon leading OCR technology,Hanvon provides an advanced and complete solution for the banking system and achieved good results in a large number of practical applications.

Achievement of objectives

Implement automation of business processes

High-speed acquisition to certificate image:All savings certificates have achieved high-speed acquisition to certificate image by scanning.According to the bank's specific needs,banks can choose different grades of the scanner.

To establish automation of credentials index:"Hanvon OCR bill\form\Documents Identification System"adopts OCR technology or flowing recognition to automatically establish accurate index of credentials which can greatly reduce the workload of manual entry.

The use of OCR technology for automatic acquisition to important credential data:For those data(account number,amount,etc.)that need significant oversight,use OCR technology to extract the actual data that users fill in credentials and make the actual data and accounting data obtained by identifying be checked to generate a data file to be supervised.And provide the data file to the savings post-supervision subsystem and then complete further post-supervision.The system uses the leading domestic Hanvon OCR technology which is mature and reliable and it has been applied in many financial institutions.The system has reached the level of practical application.

The whole background automatic process should be quickly and efficiently:background processing of a single credential(including scanning and OCR)will spend two seconds at most.The success rate of automatic recognition to the types of documents is substantially 100%.For a variety of required monitoring data(account number,amount,etc.),the success rate of OCR automatic recognition will reach above 90%.In addition,there are hand-makeup,special treatment,important credentials checking and focus oversight functions etc.

Powerful,convenient and efficient voucher searching function:After OCR automatic recognition,certificate queries can be achieved quickly and easily through LAN or DDN,X,25 lanes on the hard disk or CD-ROM library or MO data on the server.Fuzzy query can be achieved by free combination of a variety of index features;it is safe and reliable to use SOCKET transfer data packets with small network traffic.

Strict post-supervision:According to the data provided by"Hanvon OCR bill\form\document identification system",they works as the afterwards water to record the afterwards subsidiary ledger,accounts amount,general ledger,internal borrowing amount in the account balance,the balance of loan balance,out of balance,and the running account case by case on the hook between afterwards account and current account,transaction-hook between the subsidiary account and general ledger.It can achieve the automation and efficiency of the running-water hook.

Unique error management:The purpose of post-supervision is to find the error of current counter business.Thus,post-supervision fault management is a very important function.Later record all the errors when afterwards counter accounts are inconsistent with the current counter.Error management module will input non-computer error information of the supervision bills,such as incomplete bills,fake bills,illegible bills and the amount altered bills;as well as inconsistent water checking,inconsistent subsidiary ledger,and inconsistent general ledger etc.According to the error information,the generated error report will be presented to higher authorities for analysis,and generate an error notice notification for current counter’s modification.

Featured post-supervision:Mainly adopt water-based batch processing,while supporting single manual entry;the business types support for the public,savings,credit,exchange service and credential management.

Principle of System implementation

System Schematic

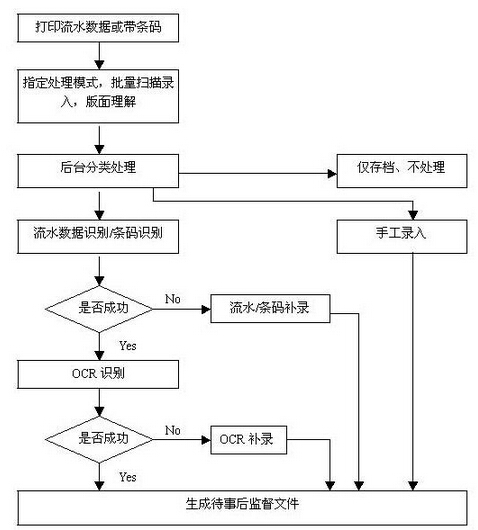

(2)Certificate treatments

Divide into three types:automatic processing,manual entry,scanning for archives.

1、automatic processing:

Objects:documents of on-line processing business at reception desk.

Automatic process is as follows:

When conducting business,bank reception should require users to fill in accordance with specifications;also print the relevant flowing information in accordance with relevant regulations.

①Scanning and inputting

Batch scanning to credentials

②Running recognition

After voucher image scanning,use OCR technology to recognize machine-printed figures,extract accounting data of the current counter and establish credentials index.

③OCR of data to be supervised

For those data(account number,amount,etc.)that need significant oversight,the use of OCR technology can extract actual data documents,and get checked with current counter data of the water,and then generate a data file to be supervised,and provide the data to the the savings post-supervision subsystem,thus completing savings afterwards supervision.

④Manual makeup:

For credentials that water or OCR fails and those need special manual handling,the system automatically displays the images credentials on the screen for the operator to view for manual voucher makeup elements and manual checking.

⑤Generate documents to be supervised afterwards

Sort out the factors of vouchers such as the voucher transaction code,account number,amount,abstract,currency,number,etc.,and generate documents to be supervised,each file every day,and provide post-supervision subsystem to supervise.

⑥Post supervision:

Specific post-supervision is completed by the bank post-supervision subsystem.Content:supervise large flowing data and afterwards files to be supervised,upload inspection results;after the end of all uploaded supervision results(for the other consideration),batch updates ledger,general ledger.Check the general ledger and general ledger sent by large machine..

2.manual entry

Objects:Certificates that are not suitable for running recognition or OCR.For such documents,only all the elements required by manual entry.

3.scanning for archives

Objects:no post-supervision,no need to establish detailed index,simply scan the image of their credentials acquisition and establish bulk index to reach the purposes of voucher disc microfilm.

Document processing(HW OCR scope of application in bank business)

(1)business to individual

Use"supervision factors"to identify all private business vouchers,receipts and combine with manual makeup and special treatment,establish index,output to post-supervision files.

(2)business to corporate

Identify all public business receipt,documents,files and output to post-supervision files.

Business processes

(1)scanning and inputting:

Since savings certificates have characteristics of large quantity,good quality and single species,the high-speed,high-resolution scanners work as certificates image acquisition tool with simple operation,rapid processing,and batch inputting.For example,configuring a scanner 60 pages per minute,it can be entered nearly 30,000 documents a day,which takes full advantage of fast automatic computer processing and greatly reduce the manpower investment with high efficiency.The image clarity of scanned documents is good with high resolution(up to 400DPI)that facilitates the subsequent flow recognition and OCR processing.If necessary,you can also print out a copy with a good reduction degree.

Before the batch scanning input of reception,specify the batch processing mode(automatic processing,manual processing,only the archive)of the credentials,understand layouts when scanning pages,and record the types of layout.

(2):side-stream treatment

When background processing,side-stream treatment will be done according to the specified processing modes by foreground:automatic processing,manual processing,no processing.

(3):transaction code settings

(4):layout settings

After the completion of transaction code,layout setting is conducted.And then associate the transaction code with the types of layout to establish corresponding relations,this relationship may be one to one,one to many,many to many.Then each layout area will be designated to deal with the OCR process.

(5):running water recognition

Traditional document indexing mode is entered manually,that is,the entry operator will take images for certificates to manually enter each element of credentials to establish the precise image index for easy inquiry.This indexing approach is slow speed,inefficient and error-prone,which is disproportionate with input scanning speed and its reliability.

Automatic method to establish precise index to credentials

①running water recognition

Running water identification does not need to print bar codes at the front desk counter.Running water recognition is through OCR to recognize the machine-printed certificate number(these numbers contain a serial number,the number,transaction code,account number,amount and other information),and obtain elements of certificates and treat them as a proof of the elements.

Running water recognition can identify all the required identification data printed on the voucher,it can be identified only by number and serial number.Using the former approach,the bank does not need to create accurate index data for matching,and because identification is current counter data,so it can monitor whether running data of the large machines are tampered.Using the latter mode,it needs to be paired with the bank running water data(through the number,serial number),and then indexed.

②Pros and cons of running water recognition

Pros:Do not need to modify the foreground printing process,without increasing the processing time of reception in the laboratory with a high recognition rate,and similar bar code recognition.Cons:Low anti-interference ability,so in practice,the requirements to the cleaning and printing of the vouchers is very high.To identify the machine-printed figures needs to play in a fixed blank position with no self-checking.The results can not guarantee the correction,and recognition speed is slower than that of bar code recognition.

(6)OCR:

Traditional savings post-supervision,which is a video surveillance operators take pictures for credentials by manually re-enter all the credentials elements as a basis for the supervision to banks large machine accounting data.In this method,there are also shortcomings:slow,inefficient and error-prone.

Using the current high-tech--OCR,extract important data amount,account and other credentials directly from the image,which replaces human manual entry and is closely connected with bar code recognition/flowing identification to achieve the establishment of a afterwards copy of the account and completion of the post-supervision work.

OCR processing is using the current leading Hanvon's OCR handwriting and printed identification technology that can identify various handwriting characters and figures written by different people used in this system.The information of credential identification to image filled by depositors such as amount in words,amount in figures,number,maturity date,identification number,etc.can replace manual entry.In order to achieve high recognition rate,you may need to modify the layout of printed documents in order to facilitate OCR recognition.After extensive testings of the actual certificates generated by the bank,we can reach more than 85%recognition rate of the actual application by our efforts,.

OCR processing performance is generally better to use a PC.The start of OCR processing program is to automatically scan the database credentials through images,and find the unsettled images by OCR to extract and processed locally.

The main contents of the OCR process is to recognize amount in figures and check the recognition amount with flowing recognition amount.If the check is successful,the OCR will success.This treatment is to avoid false positives.

(7):manual makeup

Vouchers by running water makeup,OCR makeup,special treatment,manual entry will be uniformly centralized processed and the transaction code will decide the contents to be entered.

(8):generate the post-supervision files

Post-supervision files are the connectors of the background automatically handling system and post-supervision subsystem.Only all vouchers have been processed,files can be generated after supervision.Before they generate,statistical verification of important documents will be done.

(9)Post supervision:

Inquiry of Microfilm electronic documents

Electronic documents already archived can be queried by date,account number,summary,document number,any combination of elements or unique elements.It can also be carried out through a coarse index of batching queries.

Module Design

According to different implement functions,the process is divided into five modules,namely,the front desk entry module,automatic background processing module,the central management module,query module,the afterwards supervision module.

Previous Article :Bank counter paperless business acceptance solutions----E-signature

Next Article :Hanvon OCR enterprise bill/document/form/archives recognition solutions